What is fintech?

FinTech, which is a combination of the words “financial” and “technology,” is a phrase that refers to any new technology that enables consumers or financial institutions to supply financial services in new and faster ways than previously possible. Consider the difference between walking into a bank to inquire about your balance and being able to access that information in real time on your phone.

FinTech is an umbrella term used to describe various software products created by companies like Skywalk Innovations and used for financial transaction facilitation.

Why is Fintech Important?

Even if you’re unfamiliar with fintech, chances are you’re already benefiting from it. Everything from the ability to view your financial transactions online to apps that allow you to instantly send and receive money is part of the evolution of financial services.

Fintech has also impacted the e-commerce industry, making online shopping faster and safer, and even allowing you to pay with digital wallets. When you use your credit card to shop online, you are benefiting from fintech. Almost all financial transactions can now be completed without the use of a physical card. Thanks to the development of new fintech products such as Apple Pay and Google Wallet.

Fintech allows you to manage all of your financial accounts online – banking, investments, and insurance. These accounts, which were previously managed in-person or through a representative, can now be easily self-managed online.

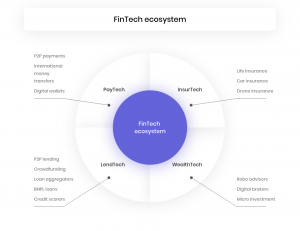

What is fintech ecosystem?

According to fintech magazine, a fintech ecosystem is a group of companies that collaborate to achieve a common purpose. This mainly refers to the development and implementation of innovative technologies in the financial services sector to improve or disrupt the traditional banking sector.

Diagram by: Softensy

Here are some examples of FinTech ecosystems to help you understand the ecosystem better.

Insurance is a critical component of today’s FinTech ecosystem.

InsurTech can be distinguished as a distinct field—in fact, this industry arose from the convergence of FinTech innovations and traditional insurance.

Through microservices and APIs, ecosystems aid in the development of InsurTech platforms. As ecosystem relationships are customizable to consumers’ goals, they also assist InsurTechs in offering solutions that fit insurers.

Example

- Uber: Uber’s connectivity and market share are rapidly increasing due to innovation, so much so that their ecosystem now includes food delivery, ride-sharing, Uber Eats, and car rentals. However, in order to work as a partner in any of those industries, you must have an insurance policy.

- Naked Insurance: They provide car insurance services that are affordable. It is completely free to join their team. Their car insurance services include coverage for accidents, theft and hijacking, weather, third-party damage, and fire.

Benefits of the FinTech Ecosystem?

The FinTech ecosystem provides numerous opportunities for all parties involved.

Below are the pros of the FinTech ecosystem.

Benefit 1: Potential for unlimited startup scaling

African fintech was one of the big stories of 2021, with the amount of funding for African fintech increasing to $2 billion compared to half a billion in 2020.

An example of a start-up that scaled: TymeBank

This is a South African virtual bank that is entirely owned by black people and is a privately controlled investment firm. It is an exclusive digital bank that aims at providing every South African with accessible and affordable banking so that they can take part in, grow and benefit from the country’s economy.

Benefit 2: The Introduction of New Products

Another great benefit of the FinTech industry ecosystem is that it helps to introduce new products to an existing customer base.

For example, Yoco. Yoco is currently one of the most valuable start-ups on the continent. What started out as a way for customers to pay businesses through an affordable card machine now offers those same businesses free software that helps them manage sales, stock, and staff.

Benefit 3: Establishment of a New Profit Stream

Owning an ecosystem motivates you to develop new products, which leads to new revenue streams. According to a Sopheon study, expanding a product catalog increases a start-up’s profitability.

Benefit 4: Use of Cross-App Data Exchange

Data synchronization between two platforms using the same account is referred to as “cross-app data exchange.” Because an ecosystem consists of multiple platforms that are controlled by a primary platform, data is exchanged seamlessly.

Because there is more data to personalize products for users, all products within the ecosystem benefit from excellent user-friendliness.

For example, Uber data is shared with Lemonade, an insurance platform, because they share a FinTech hub.

Now that you have an overview of FinTech and its ecosystem, you might find yourself wanting to learn more or wanting to solve a problem within the fintech space.

Well, now is the time to educate yourself about FinTech.

Look out for the next Skywalk blog post and learn what it entails to start a fintech start-up. Or if you would like to peruse a fintech start-up, speak to our team for guidance.